TO PRINT YOUR TAX BILL OR RECEIPT, GO TO THE WALWORTH COUNTY WEBSITE: https://ascent.co.walworth.wi.us/LandRecords/PropertyListing/RealEstateTaxParcel#/Search

1st Installments – due by January 31st.

Full payment or 1st installments of Real Estate and Personal Property Tax should be made payable to Town of Lyons Treasurer. If you’d like a receipt please include a self-addressed stamped envelope. Forms of payment accepted are Exact Cash, Check or Escrow Check. Payments can be made via:

• Drop Box located in the lobby of Lyons Town Hall, 6339 Hospital Road, Burlington, WI 53105

• Mail to Town of Lyons, PO Box 148, Lyons, WI 53148

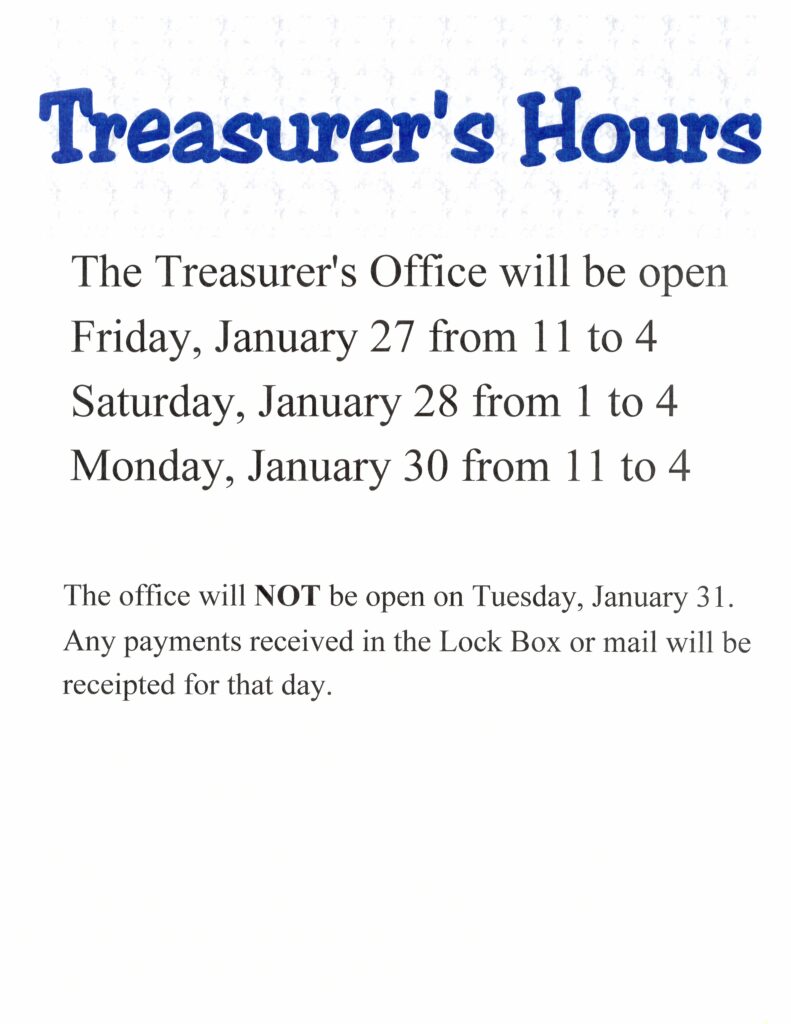

• In Person Payments can be made to the Town Treasurer on the following days:

*Escrow Check Reminder: If you are making payment with a check from your mortgage company please remember to endorse the back of the check by ALL parties listed on the front of the check. If the check is made out for more than $5 over your tax amount, a refund will be mailed once the check has cleared our bank. (Approximately two weeks after posting date.)

ALL Payments made after January 31st including 2nd Installments due by July 31, 2022 should be made payable to Walworth County Treasurer and mailed or delivered to:

Walworth County Treasurer

PO BOX 1001

100 W. Walworth St.

Elkhorn, WI 53121

Failure to follow these instructions may delay posting of payments resulting in delinquent penalty and interest.

Taxes are considered late if the first installment is not RECEIVED by January 31, 2022.

Interest and penalties will be applied to the full remaining balance beginning on February 1, 2022.